Why do Medtech Companies Need a Market Access Plan in Latin America?

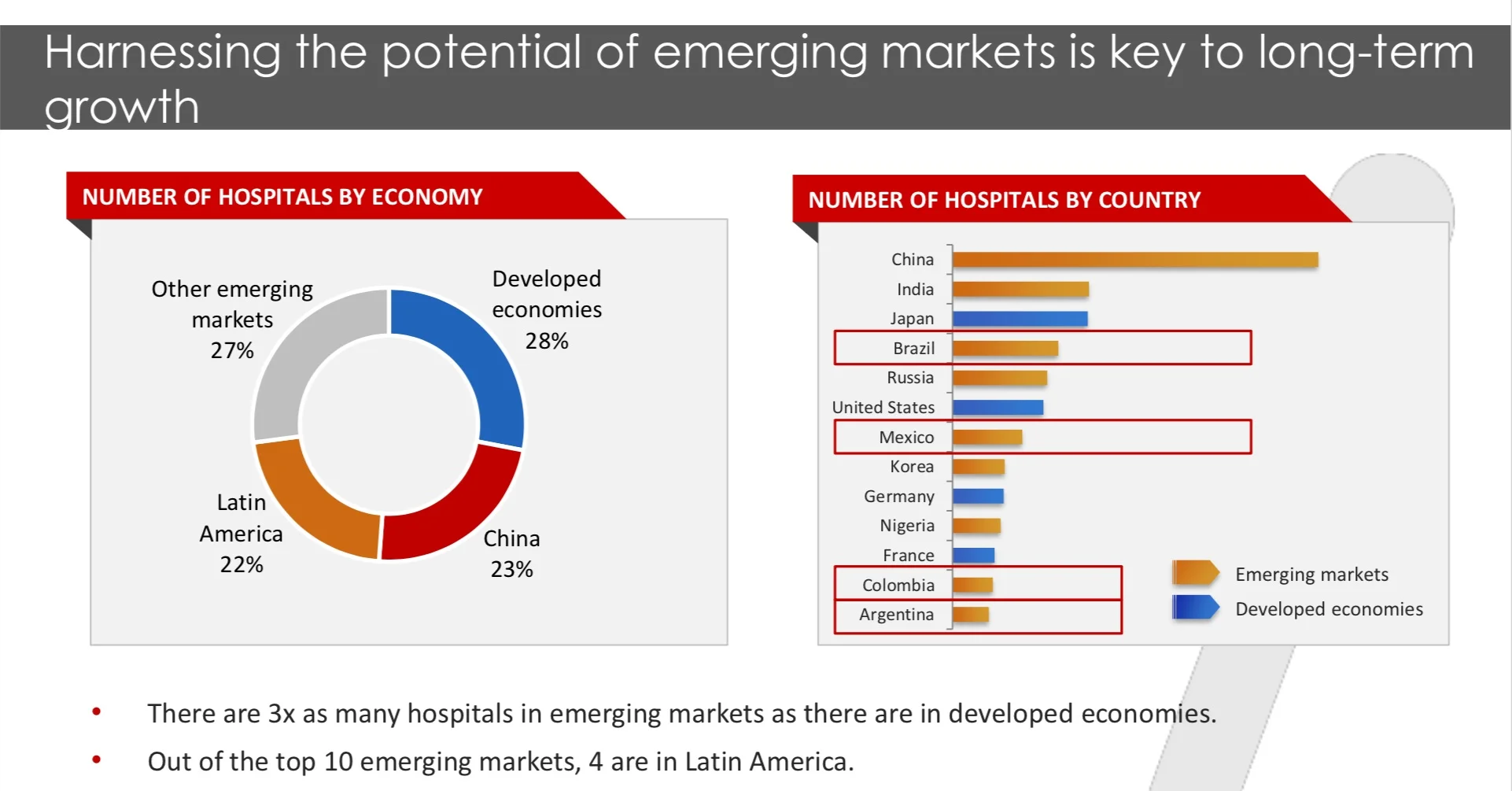

Emerging markets are the engines of growth today, and, thus, performing in these markets is critical for the majority of pharmaceutical and medical technology companies

This article was slightly adapted from an original review article written by Anuj Kumar, Karthaveerya Juluru, Phani Kishore Thimmaraju, Jayachandra Reddy & Anand Patil (2014) Pharmaceutical market access in emerging markets: concepts, components, and future, Journal of Market Access & Health Policy, 2:1, DOI: 10.3402/jmahp.v2.25302. Additional information from Global Health Intelligence (GHI), Technavio, and Mckinsey was also added.

Source: GHI analysis based on data from the OECD, CEPAL, WHO, the World Bank and certain local ministries.

According to a Technavio market research report, the medical device market has been growing rapidly in emerging countries. By 2022, more than 30% of the global healthcare expenditure is expected to arise from emerging economies. The medical devices market in emerging economies offers opportunities due to significantly high operating margins across the various industry sub sectors. This is primarily due to the large, growing, and increasingly wealthy middle class willing to pay for high-quality medical services that governments have not managed to deliver in the past.

Technavio also says that unlike developed economies that are governed by strong government and payor actions in terms of competitive pricing and regulation, emerging markets are fairly benign for healthcare companies. Several emerging economies have an increasing geriatric population and are also struggling with an increase in the prevalence of chronic diseases, which will lead to an increase in the demand for medical devices.

According to Mckinsey, medical devices in emerging economies are going through rapid growth and change. Although developed markets dominate medical device sales today (US, EU and Japan account for over 75% of total sales), emerging markets represent much faster growth opportunities with growth rates two to five times those of developed markets. This growth will be driven by,

A growing and aging population is driving higher disease prevalence and the need for associated medical devices.

Rising income and availability of insurance.

Improving medical infrastructure – hospitals and other medical facilities are making significant investments in medical infra- structure across all tiers of cities.

Increasing consumer demand: – more emerging markets consumers are seeking higher-quality care and are willing to pay for it.

Source: GHI analysis.

Market access has gained considerable attention worldwide as countries try to contain their escalating healthcare expenditures amidst the global economic slowdown. This has resulted in governments adopting stricter measures for new product approval. Thus, pharmaceutical and medical technology companies are finding it increasingly difficult to successfully address the specific challenges posed by various government and regulatory agencies and stakeholders.

There is an increasing need to establish market access functions within pharmaceutical and medical technology companies; especially in emerging markets, where the complex, dynamic healthcare landscape confounds product approval and uptake.

To address the challenges posed by regulatory agencies and diverse stakeholders, a customized market access strategy is the need of the hour. A market access framework with specific tools and tactics will help companies to plan, implement, and monitor stakeholder engagement activities.

Over the last decade, the global pharmaceutical and medical technology market access landscape has undergone a significant transition and has garnered substantial attention. This is primarily due to the healthcare reforms promulgated by governments across the globe to contain their burgeoning healthcare expenditures (1).

Traditionally, R&D, sales, and marketing have been the predominant drivers of commercial success for pharmaceutical and medical technology companies (2, 3). This traditional market access approach is very linear and involves engaging with physicians, pharmacies, and regulatory bodies for greater product uptake (4), but it includes only pricing and reimbursement activities.

Sources: GHI analysis, ECLAC, Center for Strategic & International Studies.

However, we define market access as a process that ensures all appropriate patients have rapid and continued access to the product at the right price.

This indeed is a broad concept that includes multiple functionalities from a company's commercial, regulatory, supply chain, marketing, medical, and corporate functions. There has already been a recent shift in the makeup of stakeholders to also include patients, payers, and advisory groups due to their increased role in treatment decision making. These changes have forced an evolution in market access to a value-based approach from the traditional price-based perspective. This has made market access an increasingly important area of focus for medical technology companies to achieve success through improved access (3).

Generally, market access is perceived as a function that is confined to pricing and reimbursement activities. However, in reality, it is a multidisciplinary field that includes aspects from various other business functions, such as managing channels, stakeholders, and key opinion leaders (KOLs).

Of course, the diverse market characteristics and dynamics dictate the market access situations in emerging markets. Reimbursement does not exist in many emerging markets, and where it does exist, there are several restrictions. Thus, access in emerging markets is largely a function of price, channels, marketing to doctors, insurance companies, and government stakeholders. However, pharmaceutical and medical technology companies working in these emerging markets focus on either individual functions or none at all.

In summary, the success of a pharmaceutical or medical technology company depends heavily on a robust market access strategy that is customized to the challenges of a particular market or country.

Source: GHI analysis.

Market access — then and now

The pharmaceutical and medical technology industry industry has traditionally relied heavily upon the push strategy to ensure their products succeed in the market. The product approval process was simple: it involved submitting data on efficacy, safety, and tolerability to the regulatory agencies. Once approval was secured, the local distributor marketed the product to the targeted physicians or hospitals and that was it. Thus, market access involved engaging with a limited set of stakeholders: physicians, hospitals, and regulatory agencies.

However, over the years, the market access landscape has evolved primarily due to two factors:

Escalating healthcare costs due to a growing prevalence of chronic diseases, increase in the geriatric population, and higher prices of new therapies: As in developed countries like the United States, where the rise in healthcare cost is an integral function of diagnostic and allied costs, the emerging markets also behave in a similar fashion owing to their recent advancements and reforms in healthcare systems.

Challenging pricing and reimbursement environment: Increased scrutiny of the claimed product value by healthcare authorities is restricting the pricing and reimbursement space for new products. Reference pricing and generic substitutions are among the already implemented techniques to improve affordability for marketed products (6).

These two factors have resulted in the emergence of a new and diverse set of stakeholders over the years. However, this has increased the complexity of access to the market in general, and to patients in particular.

Source: GHI analysis, OECD and WHO, 2016.

Emerging stakeholders in market access

The payer is undoubtedly the stakeholder with the highest prominence. The payer exercises the greatest degree of control over pricing and reimbursement for any new medical product (7). Payers also proactively participate in establishing treatment protocols and have an influence on prescribing behavior of physicians. Payers will continue to dominate the market access scenario and are key to a new product's success on the market (8).

Patients today are more aware of treatment modalities and can be expected to demand justification for the price charged for a drug or a medical device. This is because patients have to bear the additional cost of high-priced drugs through co-payments (in such cases, they become payers as well). In addition, Patients are more concerned about the effectiveness of the treatment than earlier, and they are not satisfied with just receiving treatment but also demand a cure. Indeed, the importance of product effectiveness will further increase if there is no reimbursement or only partial reimbursement.

Pharmacies are key stakeholders who could influence product access by controlling the availability of the product in the retail or out-of-pocket market. In cases of reimbursement, pharmacies could also influence the choice of brand through substitution. Understanding their dispensing behavior and securing the most shelf space are important for product success.

Advocacy groups are gradually beginning to exert their influence as stakeholders in market access, especially in niche therapies where the cost of treatment is very high (e.g., in rare diseases). Moreover, they wield considerable influence in healthcare policy shaping and indirectly affect treatment guidelines.

Physicians and KOLs have seen some reduction in their importance in the market access value chain over the years. The growing austerity measures have influenced their prescription behavior to a considerable extent. As companies struggle to spend quality time with these important traditional channels, it will be a challenge to effectively engage and explore areas of common interest.

Government bodies and regulatory agencies are a complex group of stakeholders that play a vital role in shaping healthcare policy and establishing a framework for pharmaceutical and medical technology companies to operate within (e.g., setting pricing and reimbursement guidelines). In some countries, they are the payers, and they hold the key to the market and will continue to exert significant influence. Pharmaceutical and medical technology companies will need to effectively manage this extremely challenging group of stakeholders to succeed in the market (9).

The decision-making landscape in the healthcare system has become quite complex, with intertwined relationships among various stakeholders. The involvement of different stakeholders in the market access process varies by therapeutic area. Knowing the relevant stakeholders as well as their needs and interdependencies is critical as it greatly determines the success of market access activities.

Source: GHI analysis.

Market access scenario in developed markets versus emerging markets

In the developed markets, the market access function has steadily attained importance due to increased awareness of the need for value over existing treatments among regulatory and reimbursement agencies. To deal with this dynamic regulatory environment, pharmaceutical and medical technology companies have started to establish the market access function as an integral part of the organization. However, only a handful of companies currently have a dedicated market access team with well-defined roles and responsibilities (10, 11). Instead, the majority of companies currently have a splintered approach, with market access responsibilities being shared among sales, marketing, and regulatory divisions.

In the emerging markets, market access is still not as well structured as in the developed markets. However, the changing market landscape and evolving healthcare policies have led to increased importance of market access functions. Despite this, currently, pharmaceutical and medical technology companies are focusing on individual components of market access (price, channel, stakeholders, and government agencies), but there is no holistic approach to deal with all components together. Moreover, the healthcare policies and regulatory landscapes in these markets are more complex than in the developed markets. Pharmaceutical and medical technology companies thus find it difficult to identify the right stakeholders that need to be engaged as part of the product approval process. Moreover, companies do not have established processes, plans, and talent to circumvent the challenges posed by the various stakeholders in market access. Hence, there is a greater need for a dedicated market access team. Taking note of this, a few pharmaceutical companies have started to establish market access function (10, 11), however, medical technology companies are behind on this trend.

Market access involves engaging with all components of a market and with different stakeholders who impact the overall product commercialization process. Thus, customized processes and functions are required to effectively engage these stakeholders. The key challenge is to integrate these processes and functions so as to minimize overlap and duplication, which might result in suboptimal product uptake and wastage of resources.

Source: GHI analysis.

Key success factors for market access function in emerging markets

To succeed in such complex markets, a pharmaceutical or medical technology company will require a comprehensive market access strategy. This has to be closely aligned with other corporate functions and customized to local challenges. The healthcare landscape in the emerging markets is complex and does not follow a structured drug approval process, as compared to the developed markets. Market access involves various processes and activities for engaging with a diverse set of stakeholders. The following are the key success factors that a company needs to adopt to gain smooth market access:

Integrated market access strategies, beginning from the product development stage

Developing a culture of team effort by facilitating effective collaboration among various business functions (e.g., sales, marketing, regulatory, etc.)

Key account management (KAM) or specialized teams dedicated to managing stakeholders

Adopting an integrated stakeholder management approach

Better understanding of the relationship between market access and stakeholders

Effective communication with internal and external stakeholders

Establishment of optimal processes, plans, and, most importantly, people

In addition, the market access strategy has to be closely aligned with other corporate functions and implemented through appropriate tactics to ensure product success. A dedicated market access team with a collaborative working dynamic, built through a brand-team culture, will enhance the speed of product uptake and act as a catalyst for organizational growth.

Source: GHI analysis.

Market access in the future

The current volatility in the global economy is expected to continue into the near future. Moreover, pressure from governments to contain their burgeoning healthcare bills will also continue. Thus, market access is expected to assume greater significance, particularly in the emerging markets. Pharmaceutical and medical technology companies need to proactively engage with the key stakeholder groups in order to keep up with their potential future needs.

This is critical to effective product commercialization since the future success of an organization often hinges on its ability to understand and embrace changes in a dynamic healthcare environment. These changes should not only be confined to organizational structure but also percolate to all business processes. Most importantly, pharmaceutical and medical technology companies must adopt a market-access-oriented organizational mindset.

The stagnant developed markets have forced pharmaceutical and medical technology companies to focus more on the emerging markets, which are touted as being the next engines of growth. Thus, growth for any pharmaceutical or medical technology company will depend on its performance in these markets. A customized market access strategy integrated with the right processes and talent can help mitigate these challenges, allowing effective commercialization and increased drug or medical device accessibility for patients.

Mckinsey recommends that medical device companies entering emerging markets should look to establish local leadership and taylor new products with local R&D, and should move from a hands-off distributor management to a proactive hybrid model.